Keep That Crypto Safe!

Investing in cryptocurrency is inherently risky. Blockchain technology is an emerging market, which makes it like the Wild West. There is a lot of opportunity, there are also many ways for you and your money to get left in the dust.

The potential upside for a cryptocurrency investment is tremendous. That means the potential for loss is also tremendous. Here are five ways to protect your crypto investment so it grows long into the future as the asset becomes adopted.

(If you have questions about any of this, we invite you to contact us.)

1. Choose a blockchain with high security standards

There are tens of thousands of crypto projects building today. Some will be here in ten years, others will fail and result in painful losses. Choosing the projects with the greatest potential for longevity and scalability puts an investor in a strong position to grow with the assets. But, how to sort this out?

Every crypto investor needs a fundamental understanding of the relationship between layer one and layer two solutions. Blockchains are layer one solutions. These teams are building the blockchain environments, each with its own model, characteristics, and opportunities. There’s not just one blockchain, there are many.

Layer two projects are building on layer one blockchains. Just like projects like Shopify and Facebook added e-commerce and social media capacity to the Internet, layer two projects are adding specific utility to the blockchain on which they’re building.

The blockchain is responsible for the secure infrastructure that all other projects use to add functionality. Which blockchain you choose will often dictate which other projects you’re involved in.

For example, if you choose the Ethereum blockchain, you’ll likely be introduced to many ERC-20 tokens, which are Ethereum’s native tokens. If you choose the Cardano blockchain, you’ll likely dive into Cardano’s native tokens.

You can see this explained in this video about our Cardano Model Portfolio here, which includes the Cardano coin, ADA, and 24 projects building on the Cardano ecosystem.

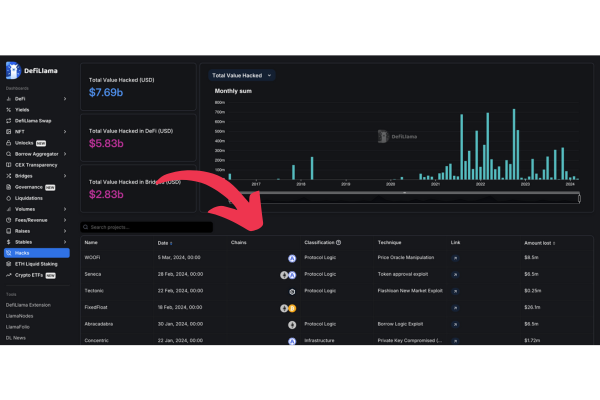

What’s a good way to understand if your blockchain of choice is secure? DefiLlama keeps a current tab on all hacks, scams, and rug pulls across all chains. This video explains the risks and tools that can help you.

You can check the “Chains” column live. If you see your blockchain of choice listed among the most often hacked, perhaps it’s time to make a change.

2. Store your cryptocurrency in a wallet, not on an exchange

Most people who buy cryptocurrency purchase it on a centralized exchange like Coinbase, Kraken, or Binance.

One of the biggest liabilities for your cryptocurrency is leaving it vulnerable to storing it on a centralized exchange. Plus, leaving it on an exchange means you can’t take advantage of any of the staking and rewards-building opportunities that a decentralized environment provides.

While those exchanges are a fine place to buy most cryptocurrency assets, they’re not a good place to store them. Most people familiar with crypto are aware of the FTX debacle where the centralized exchange folded, costing its users many millions of dollars in investments.

Unfortunately, that very public downfall colored many people’s view of the potential liabilities of crypto. However, while the exchange did allow for the purchase of cryptocurrencies, the entity itself – FTX – was a traditional centralized company whose demise had roots in many of the issues that blockchain technology resolves.

In short, it provided an example of why blockchain technology is so sorely needed. If those investors had stored their assets in a cryptocurrency wallet on the blockchain, they would have had sovereign possession of their assets. Their funds would have been protected from the losses they suffered by leaving them on the exchange.

Once you purchase cryptocurrency, take the time to get yourself a crypto wallet. What is a crypto wallet? It is a decentralized digital storage vault for your assets. While there are many types of wallets, most crypto wallets exist as a browser extension.

When you download the wallet, you’ll be guided through set-up and receive an explanation on how to transfer the funds to your wallet from the exchange.

3. Be Responsible With Your Wallet Credentials

When you have a cryptocurrency wallet, you are its keeper. This takes some time to adjust to because our digital lives require so many middlemen.

For example, we use third-party providers like PayPal and Venmo to transfer money to each other. We use a third-party bank to store our wealth. We use third-party email providers to send our information. Rarely are we in direct possession of our data, information, or funds outside of the hard cash in our purse.

Your digital wallet exists on the blockchain. To use it, you’ll receive a few credentials when you start it. These include: your 24-word (or less) passphrase, your public address, and your spending password. The passphrase allows you to install the wallet on other computers for example if you spill coffee on your laptop and ruin it. The passphrase should never be shared.

You’ll share the public address with others who plan to send you money – similar to sharing your home address with a friend who wants to visit. The spending password is required when you send funds. This should be kept private.

These three pieces of information must be stored somewhere you won’t lose them. We store ours on paper in multiple secure places so that there is no risk of loss. Because the wallet is in your direct possession, there’s no one to reset the password for you if you lose it.

You must take care at the outset to keep the wallet’s information secure and accessible to you. Part of having sovereignty over your crypto assets includes taking responsibility for maintaining your information. Having this information in hand protects your cryptocurrency portfolio.

4. Understand 4-Year Bitcoin Cycles and 60-Day Cycles

Sometimes you are the greatest liability for your funds! It’s human nature to be excited about upswings and devastated by downturns in the crypto market.

The cryptocurrency market is especially volatile, and the hype can result in emotional decisions made in haste. Don’t let yourself fall victim to FUD (Fear, Uncertainty, and Doubt) or FOMO (Fear of Missing Out).

All crypto investors need to have a plan that works for them and anticipates that things may not go as planned. A strong way to develop this plan is to learn about and understand the Bitcoin 4-Year Cycles. Each cycle includes a bear and a bull market with increases and decreases that can be in the tens of thousands of percent.

To invest and trade wisely, you must know where the price is in the cycle when you start investing. If it’s a bull market, it’s a poor time to buy. If it’s a bear market, prices will be lower and there’s good potential for getting great assets at a low price. We chronicle the swings of a 4-year cycle in this video about the timing of crypto markets.

You may also benefit from the current news and analysis in our OG Membership.

5. Keep tabs on the Crypto Coins & Tokens You Invest In

Investing is just the beginning. Once you’ve chosen a project, you have a new relationship. Protect your crypto by keeping tabs on the team, announcements, and channels the project provides. Most projects have a Discord channel, a YouTube channel, or an X channel, all of which should be a source of updates and new opportunities.

If you notice that it’s crickets from the project’s leadership, reach out. Ask your questions! Get involved. All projects are responsible to their communities. If you feel red flags are showing, do your due diligence in moving your crypto somewhere it’s secure and well-positioned to grow in the future.

Congrats on the full read! What next steps can you take to secure your portfolio?

We invite you to take it a step further and consider a Cryptofluency Membership and benefit from our 7+ years of analysis in the space. You could spend hours, days, months, and years researching, comparing, and analyzing these opportunities to narrow the most advantageous. Or, you can become an OG Member! Learn more here.